Can you believe it’s almost November? With 2020 around the corner, I’m sure many people are beginning to think about their New Year’s resolutions. If one of yours is to save some serious cash, this post is for you.

Personally, I’ve only recently begun to get smart about my money. After reading some personal finance books, I’m feeling super motivated to get started with building my nest egg, especially since my generation is likely to live longer than any before us. That means that we have a long life to prepare for, especially if we plan to retire at 65. That could mean 40 years of retirement, which will be impossible to pay for unless we start saving now.

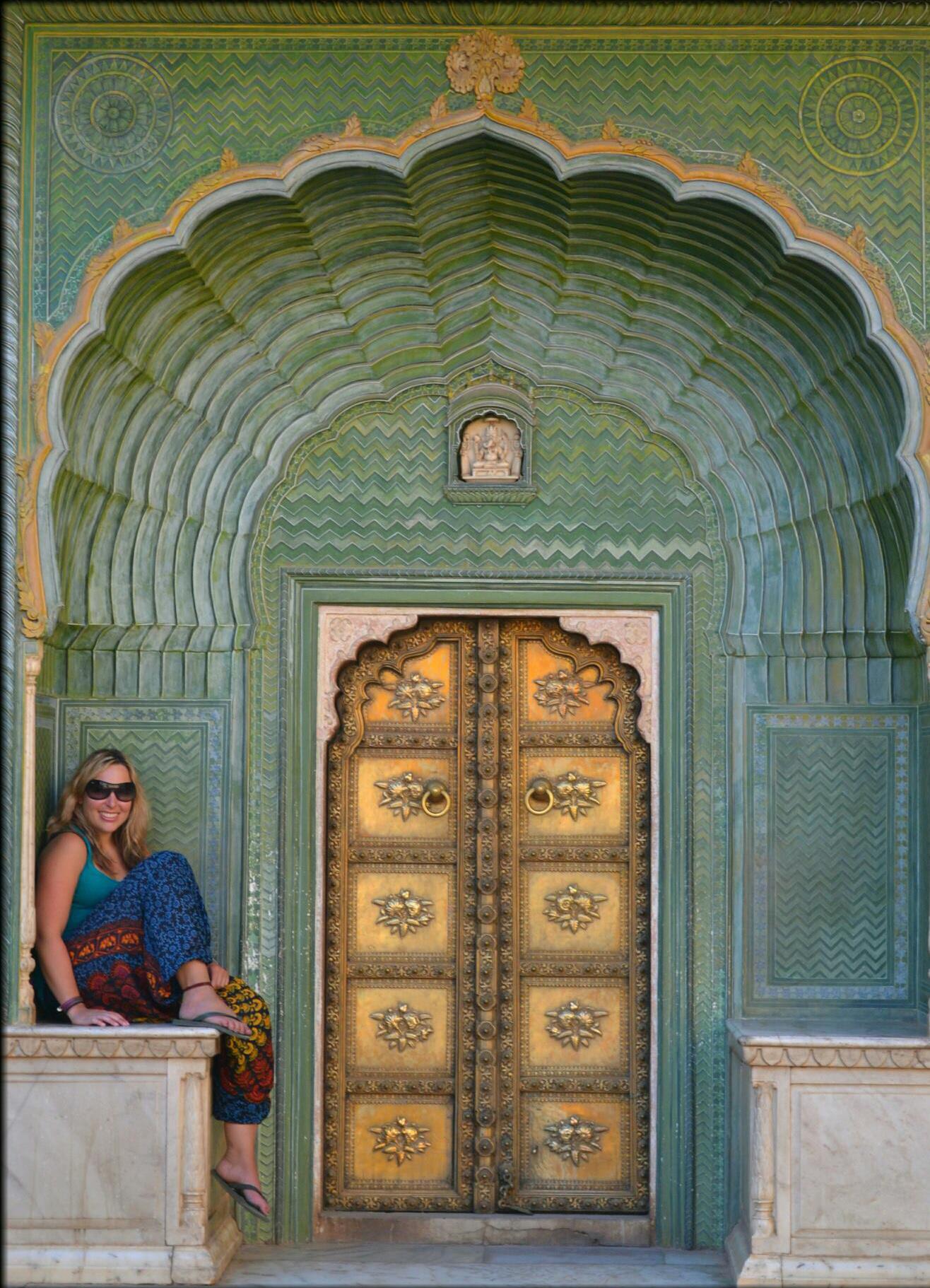

I don’t want to be struggling when I’m older. Instead, I’d like to have free time with my family, take exciting trips around the world, and be able to enjoy my life. But I also want to be able to enjoy life now, and that means going out for brunch, having drinks with friends, and shopping at the occasional sale. So how do you do these things while still saving for things like retirement and a house downpayment?

Smart decisions. Here are a few ways you can save in 2020 while still having a life:

If you’re anything like me, you’re probably paying more than you need on things like subscriptions and utilities each month. For example, most of us are paying way more than we need to on things like cable and phone plans. Did you know that you can get broadband and TV deals that work out cheaper than paying for them both separately? And since there are many different plans to choose from, you can find one that suits your exact needs.

These plans combine your TV and broadband, so you’re no longer paying for them both separately. And since they’re bundled together, you’ll pay much less than you would if you were dealing with two separate providers for both of them.

Love drama? The Big Bundle + Drama Pick could be right for you, and at just 38 pounds, it’s a steal. Want to watch Netflix on your TV? Check out the Big Bundle which is even cheaper and includes 125 TV channels along with internet. There are also plenty of other great broadband and TV deals, depending on how much internet you need, how fast you’d like it to be, and the types of TV channels you like to watch.

Create a budget

Talking about budgeting is no fun, but there’s a reason why it works so well. And putting yourself on a budget doesn’t mean that you need to sacrifice fun and going out. Instead, it just means that all of your bills are paid first, and you transfer a dedicated amount into your saving and retirement accounts at the same time. Whatever is left is yours to do what you like with.

“But what if I can’t afford to save?” I hear you ask. Start with $5. As you see the money add up, you’ll find ways to cut out the things you don’t find necessary and add more to your savings.

Choose what you love

This goes hand in hand with your budget. Love shoes? As long as you’ve paid for your bills and you’ve also contributed to your savings, go ahead and get those bright red stilettos you’ve had your eye on. The best part about budgeting is that you have money for whatever you want- without the guilt.